Achieving Personal Growth in 2023: A Complete Guide

Importance of personal growth and development for Happy Life

Neuro Linguistics Programming

NLP (Neuro-Linguistics Programming) is a new technology used in modern practical psychology to alter the power of the human mind to achieve personal success. In the 70th century, two American scientists (Richard Bandler and John Grinder under the anthropologist, social scientist, linguist, and cyberneticist Gregory Bateson, at the University of California) found this modern observation. Then a lot of personal development researchers improve these techniques into different subsections called Seishindo, 5S, Somatic Communication, Synergy, Synergy PLUS, Silva Ultra Mind, etc. Today NLP is powered by Indian classical Yoga, Parapsychology, Buddhism, and Quantum Physics. The basic concept of the NLP is stimulating neuron cells in the brain via doing programming to the mind or converting negative neuron patterns into positive neuron patterns via five senses (i.e. eye, nose, ear, skin tension & thinking). From these mental converting, negative human behaviors can be changed into positive behaviors. So we give some guidelines of the NLP for Lanka Wisdom visitors which can be used to improve their personal life. Here we discuss some very simple & practical activities which you can use in your daily life to achieve your personal goals.

This article will introduce modern mind science theories and practices, then look at the health side which is so important to a happy life. Then we will look at different ways of applying methods for NLP and stimulating factors of mind powers. Then we will discuss how lifelong education is important and let we will do a simple meditation. When you need a new life partner he or she will interview you, so let's talk about how interviews and discussions help your progress. Team working and financial management are also important for a happy life in the current stressful lifestyle. Finally, we cover that points. Following simple ten rules tell how is our mind functioning naturally:

- The mind can be controlled, guided & used for creativity.

- Without self-control, the mind can be destroyed owner's self & automatically goes toward criminal actions.

- The mind influences every subatomic realm in internal and external living beings & physical objects.

- Only thoughts are more important than anything, so our physical body is just a medium to the mind.

- Very important activities are firstly created inside the mind of any particular person.

- All thoughts which are created inside our minds are not true or correct.

- There have beings in the universe who have only minds with energy bodies.

- After dying, consciousness jump into another life as the concept of reincarnation in Buddhism.

- There has war inside our minds between the justification of good and bad actions.

- Every moment's mind creates new energy packets which save in the universe called karma.

Seven sections in personal life which want to be balanced & continually maintained

- Family Life - Happy relationship & pure love increase your mind power, so it will give extra energy.

- Health - This is a treasure for any living being on earth, without good health any goal can't be achieved.

- Life-long Education - Learning is not limited to certifications, age, time, job, or any social state.

- Economic Independence - Save money & reduce expenses is important, it gives relaxation to the mind.

- Emotional Controlling - Some emotions are wanted rather than reduced, some are wanted to stop totally.

- Religious Activities - Your religion helps you to get more relaxation & calm within daily life.

- Social Life - Even friends & relations are needed, you want to keep wisely limitations with every bond.

What makes a Super Healthy?

- Super Healthy is an idea for staying without serious diseases such as diabetes, high blood pressure, cancer, virus inflections, phlegm, accidents, stress, tension, etc...

- Mainly via controlling foods & sleeping, keeping mind with relaxation, we can achieve super healthy concepts. Here we are not mentioning that we can stay 100% super healthy, but we can close to that state.

- So we are going to discuss some concepts for attaining super healthy & how we keep that state forever…

- Remember that what you eat reason for what you be, its effect on the mental side & physical side. Take well-balanced nutritious meals including fresh fruits, green leaves, and vegetables.

- Drink water as you like, it keeps you fresh. If you don't like pure water then drink milk or fruit juice without adding much sugar. Fruit juice is very good for making our minds fresh & increasing concentration.

- Eat easily digesting meals in break first because as soon as we wake up in the morning, our body just starts its complex chemical reactions. Eat a good wholesome meal at lunch & take a simple meal at night. Because while sleeping our biosystems are starting to relax. Use to take a little nap after 30minute from lunch.

- Use to eat fruits & vegetables without a cook or boiled. Reduce added sugar, sweet stuff, cola drinks, coffee, tea, and alcohol solutions. As soon as you eat don't do any mental or physical exercises. Drink herbal leaves with boiling water even once a week.

- Remember this formula - Sleep with Sun & Wake up with Sun - Whatever job you did or do, get wholesome uninterrupted sleep for about a minimum of eight hours. Because without good sleep, loosed sleeping time collects as a "sleeping loan", which can destroy you at important moments such as exams. Also, remove sleeping loans via sleeping long time and settle these loans.

- Beware of bathing with cool water at night time or on cool days. It is good to use little hot water which stimulates your neuron cells, and then it gives good relaxation too. The best time for bathing is 10 AM to 3 PM.

- If there have physical & mental sicknesses like Drowsiness, Ophthalmia, Catarrh, etc, take medical treatments from qualified doctors, and don’t use sleeping tablets or memory-increasing drugs.

- Do little exercises such as yoga, walking, cycling, running, etc. Do breathing exercises such as meditation or pranayama yogic breathing. Learn Deep Muscle Relations exercises from a good counselor.

- Read Ayurvedic (herbal medicine) books & discusses ancient knowledge about health. Sometimes your grandmother knows Super Healthy Tips more than your family doctor!

- Don't watch highly adventurous & sexually stimulated TV programs, films, books & dramas before your sleep & as soon as you wake up. In the morning time read religious books instead of newspapers.

- Prepare Auto-Suggestion relate to your physical & mental health. Do listen to relaxation music...

Color Theory: How to Heal with Color Therapy

- Colors are very important to stimulated cells of the brain. Some colors are identified as stimulators for our daily activities such as education, earning money, cure sicknesses, etc.

- The green color is important for stimulating brain cells towards earning & saving money.

- Brown, Yellow & Orange are greatly important with education, religious activities & calm our mind.

- Blue is stimulating brain cells towards achieving personal hopes & goals in life.

- Violet makes fresh our mind & reduces tensions, stress, or phobias.

- Red is identified as helping cure diseases & improve our immune system.

- White is clearing your mind from confusion, problems & sadness.

- Purple is increasing our social bond with society. Pink is used to improve personal relationships.

- However Black is creating confusion, sadness & stress inside our minds.

- So you can use these colors in particular places in your house, for example, you can grow a garden with green leaves so which help to stimulate your brain toward catch opportunities for money-making while a student can use yellow, orange or brown colored table cloth when they are studying.

- When you choose desktop pictures for your computer or mobile phone, select colors which are your mind stimulating into freshness.

Auto Suggestions: Daily Affirmations for Positive Energy

- Auto suggestions are the main & traditional NLP technique that is used to talk with our lower mind. According to NLP mind is divided into three parts conscious mind, unconscious mind & subconscious mind. NLP accepts reincarnation so all our daily activities & thoughts are stored in the karmic realm can rake via the subconscious mind. But the unconscious mind helps to communicate between the conscious mind & subconscious mind.

- For our easiness, both of unconscious mind & subconscious mind are called as lower mind.

- We can test our lower mind & its power. If you think “Tomorrow I wake up at 5 am." (That you want to wake up morning at a particular time) before 30 seconds you sleeping. You can wake up on time without a set alarm.

- Also, our other personal goals can be informed to our lower minds. This is called Auto Suggesting.

- Autosuggestion is done by using the eye & mouth. If you need something you can write down it in a short sentence & you want to read it before sleep & after wake up. At other times you can read it loudly. This is simply an Auto Suggesting. But for advanced results following rules need to be considered in Auto Suggestions.

- Write down in short sentences & present tenses NOT in past tenses, future tenses, or as hopes. If you can put the expected date & all details (place, color, taste, etc) about your goals, it will increase your income.

- You can use notebooks or cards as writing media, but it should be your handwriting, NOT printed format.

- If you can, stick relevant pictures about your goals near your sentences.

- Don't show or tell anyone about your autosuggestions. If you do so its power of achieving will be late. This is a scientifically proven thing, so keep this rule in your mind.

- You can use Auto Suggestions to improve your education, earn money, find a job, etc...

- Also, you need a good character to achieve your goals via Auto Suggestions (Actually via your mind power).

- If you doubt your goal don't write it as Autosuggestion. Our mind has an instinct for grabbing the right things and refusing unwanted things. It can see our future and karmic incomes.

- You can use Auto Suggestion to remove your negative habits such as smoking. But you want to write it as now you are already removed that bad habits.

- Also after your goal was achieved via Auto Suggestion, you need to give thanks for your lower mind with some treatments such as eating what you liked meals or buying a book related to mind power.

- Auto suggestions are also called self-suggestions and when it is having short statements such as "I’m happy" then it is called affirmations. Affirmation is a positive group of the word and is sometimes easy to use before sleep and after waking up. You can say affirmation seven times to activate its power.

- Example Auto Suggestion: "Before the 2xxx year-end of May, I will attain my own home with two bedrooms, nice kitchen & tiles floors. I will work hard for my own house”. This is an example of a good Autosuggestion that was used by most successful people.

Relaxation Music & Mental Visualization Tips

- The alpha level is a state of our mind, which we can feel in our lower mind. Normally our brain patterns stay at the beta level when we do daily work. When we are in deep sleep, we go from the beta level to the alpha level & beyond that. At this alpha level, our mind is so calm & relax. We can reduce our tension & negative hormones at this level. Thus relaxation music helps to achieve super health.

- Also, we can do Auto Suggestions & Mental Visualizations at this level. Scientific research shows that if we think of our goals at the alpha level, we can achieve our goals easily. Our lower mind gets powered at the alpha level, so can use this state to tell our life goals.

- Beta level (β - Frequency range above 12Hz), Alpha level (α - Frequency range between 8-12Hz), Theta level (θ - Frequency range between 4-8Hz) & Delta level (Δ - Frequency range up to 4Hz) can be measured via EEG instrument which is used for analyzing brain operations in medical centers. Theta level & Delta level are occurring in far most deep relaxation in the mind which can be attained via hypnotizing therapy.

- Relaxation music used to go into the alpha level. Meanwhile, listening to relaxation music, we gradually go to alpha level. So we want to know what are these relaxation music & how we identify those.

- Relaxation music must use two or three musical instruments only.

- This music is noiseless, continually spread up from 20 minutes to 30 minutes. You should not be interrupted while listening to this music. As soon as the music stops, you want to see a photo that makes you happy.

- You can sleep with soothing relaxation music but it should not be too much loud or silent. Keep the music player somewhat away from yourself that its electromagnetic waves are not disturbing your brain functions.

- Indian Classical music can be used as great relaxation music so-called Ragas and Divine Chants.

- Relaxation music doesn't use human voices, so only use natural & traditional musical instruments such as water flowing, bird noises, piano, flute, violin, soft drums & low noise instruments.

- Indian relaxation music uses some human voices such as mantras which are considered as best relaxation music. As western relaxation music, we can use symphonies of Beethoven, Mozart, etc...

- Buddhist people can use parittas and verses. Normally when we do daily meditation, we should not use any type of relaxation music, so our meditation should naturally go that you may listen to the sound of nature such as the sound of wind or the singing of birds.

- Only you need to lie on a soft bed then listen to music tracks via a CD player or other players. It is good you use stereo headphones rather than normal speakers. If you have an MP3 player or multimedia mobile phone you can use them when you are sitting in a comfortable chair.

- While you do relaxation music exercises, you can imagine that now you have achieved your goals, you want to feel the happiness & courage you were attained when your life goals are achieved. Also, you can combine places, smells, tastes, sounds, etc, which are related to your life goal. This process is called Mental Visualization. This is a very powerful tool for our success.

- By doing Mental Visualizations with Auto Suggestion you can achieve your targets in a short period. Via relaxation music, you can contact other energy beings like gods.

Positive Thinking: You have Power over your Conscious Mind

- We have a physical body & energy body. The physical body is maintained by foods while the energy body is maintained by Chakra or Energy Centers in the astral body. There have mainly seven chakras in different places in the body. Our body & mind is powered by these seven chakras. To keep fit our physical body (from diseases & negative hormones), firstly it is needed to keep positive thinking patterns.

- If you think the negative way then your chakra becomes weak. But if you can think of a positive & fresh way you can achieve ultimate mind power which is enough to gain all of your life goals. So here we give some ways that how you can maintain positive thinking way. Also, these ideas can be used in your Auto Suggestions.

- Read books about religious, psychological & positive thinking. My favorite book on positive thinking is LIFE AFTER DEATH by Mary T. It shows us how to manage our life even after death.

- There have many daily podcasts for positive thinking that you can listen in YouTube or on your phone. Don’t waste your time on social media which may ruin your whole day. My favorite podcasts for positive thinking can be found in Mind Valley. You also can listen to these podcasts to empower your life in many areas.

- Understand what you can do, also what you can't do when comparing with your skills, talents, and resources.

- Understand inborn skills & inborn weaknesses.

- Understand that you can make mistakes, especially when you do the task for the first time. It is a normal thing. It is not your fault. Other people don't have the right to blame you in such cases.

- You have the right to say I don't know or I can't do it. But you want to be honest with yourself.

- You have the right to ask something from someone.

- You have the right to love someone & also get love from others.

- Others don't have the right to destroy your life goals, so you can neglect others’ negative behaviors.

- You can courage others by using words & helping them. Also, it is your right & responsibility.

- You can plan your future as your likenesses, by consulting your family members & past karma.

- Our brain has two sides. The right side helps to do creations, fantasy, music, arts, etc. while the left side is helping with do logical thinking, mathematics, sciences, grammar, etc. So you can make your character positive way by using both sides of the brain. When you do meditation, you can use both sides of the brain at the same time. Also when you listen to relaxation music, your brain use functions on both sides. When you use both sides of the brain, your mind power will develop.

- If you respect to particular god or group of deities, offer flowers, light lamp/candles & light incense to stick to them every day. Ask for help from them via your mind for success in your life.

The Law of Attraction: A guide to wealth & love

The philosophy of the Law of Attraction can be summed up as follows: an individual's thoughts will into existence experiences that match their conceptions. According to this branch of the New thought movement, if someone thinks negatively then bad events are likely to follow, but if someone thinks positively good experiences are probable to occur. Although similar teachings can be traced all the way back to the ancient Chinese philosopher Lao Tzu, the Law of Attraction movement itself has its origins in the New Thought philosophy co-founder Phineas Quimby.

Quimby was a nineteenth-century American mentalist and mesmerist. Throughout his life, Quimby suffered from tuberculosis and during his lifetime there was no solid treatment for the debilitating illness. Quimby noticed that when he rode his horse and experienced an exceptional level of excitement he found temporary relief from his ailments. This discovery spurred Quimby to study what was referred to as Mind over Body. According to Quimby the illnesses of the body occur when the mind has been tricked into thinking it is sick by an unseen foe.

By 1877 the term Law of Attraction first emerged in the essay Isis unveiled by Russian author/occultist Helena Blavatsky when she suggested that human spirits have an attractive power. In 1886-1887 American humorist/author Prentice Mulford played a crucial role in popularizing the New Thought philosophy when he published in his essay The Law of Success ideas explaining the Law of Attraction. Over the following years, a multitude of authors and thinkers have contributed to the teachings of the law of attraction with the most notable example in recent times being the 2006 documentary The Secret and 2007 book of the same name.

As the New Thought philosophy matured people have turned to The Law of Attraction as a guide to transform their desires into a literal manifestation. Such aspirations include an abundance of wealth, business success, and relationships to specific persons. Perhaps the most popular being the acquisition of money and finding the perfect soulmate. We will now review some of the techniques the Law of Attraction teaches people.

According to the Law, for the manifestation of one's desires to work self-reflection is required. Ask yourself, am I understanding my desires? Do I want to achieve prosperity at business? Do I want to gain wealth? Do I seek relationships, such as love from another person? Then ask yourself if I were to achieve my goals will I feel better and if so, why?

After self-reflection has been completed one should try to get rid of as many obstacles in their way. The biggest being a negative mindset. As stated by the Law, negative thinking leads to negative outcomes. Depending on the circumstances you find yourself in, this can be a pretty difficult task. Take care of yourself and do a little experimenting to find out what activities work to make you feel better. Other hurdles to try and eliminate are downers that make you doubt yourself. If possible, try and spend as little time around these people as possible. Obtaining a positive mindset is probably the hardest part and patience is often required for it.

Once the barriers holding you back have either been eliminated or reduced you can work on visualizing your goals into manifestation. This can be done through using your mind's eye. The mind's eye is when you let your imagination take hold and envision your objective. If you want a romantic partner then visualize him or her. Imagine not only their physical appearance, but also their voice, and even their scent. Conceptualize their personality. Are they introverted or extraverted? Are they the life of the party, do they enjoy long walks on the beach? Add every detail that you can think of. A similar approach is recommended for obtaining wealth. Imagine what way you want to make money. Do you want that promotion at work, or are you an enthusiastic entrepreneur with a business venture in mind? Picture every little feature that you can think of, allowing yourself to feel the happiness and relief of your own personal wish being formed.

When you have succeeded in determining your goal, gotten rid of your self-doubt, negative influences and envisioned the end result of your desire you must act. You will know better than anyone else what that means. Do I go out to bars and hunt for a mate, or do I start drawing out plans for my new business? Your vision is unique to you, as are the actions required to turn it into a reality. However, the Law of Attraction demands that you do not lose faith and that you keep on trying.

How to be a Good Learner?

- From this concept, NLP introduces how we learn new things without wasting time & without applying more mental or physical stamina. For learning fast we need to keep good concentration. We want to use the left & right sides of the brain to achieve the best results from education. More than passing the exam and taking a certificate, education is perfection which practices our mind to think and become wise. And do service to mankind from our knowledge.

- The below guidelines will help you to increase your learning speed. To make yourself a good learner, you should have positive daily affirmations for lifelong learning and studying new facts. You should expand your interest into many fields.

- Keep your learning room & table clean. Use pleasant light & room color. The light bulb must be placed 3 meters away from opposite to your writing hand side.

- Understand your most liked subjects & keep books related to those subjects in your book rack. Your book rack must be placed near your eyesight. Also hang posters related to your most respected people, scientists or great person in your life, educational materials in front of your table & your bed.

- Don't keep any books on your table. Put all books on your book rack or another separate place. But you can keep a computer, calculator & some little stationery inside a stationary holder on your table.

- Keep your education functions under timetables. Put most difficult subjects in first periods, which you don’t like to learn. Also, divide learning periods into a maximum of 30 minutes then take some breaks. Use some time for your hobbies, sports & entertainment. Try to study for 2 hours per day.

- Use relaxation music, when you read books & solve math problems.

- Try to use a computer or calculator with your education. These instruments are not destroyed your memory but they help to increase the functionary of your left side of the brain.

- If you are an art student do some hobbies related to Chess, solve math problems, learning some technical subject or new languages apart from your normal study areas.

- Read books & magazines. Read novels. If you are learning science or math, try to learn any musical instruments, listen to songs, or watch good films or TV programs.

- Take life seriously; don't live in a fantasy world when you are learning. If you are staying with a love life or family life, use those things as a support factor to education. Discuss & exchange ideas with your life partner.

- Always divide large study loads into little segments. For example, if you happen to read or remember 6 chapters from books within two days, you can divide one chapter into one hour, and then three hours per day - so this way you can easily finish your load within two days without working hard.

- Hang your educational achievements such as certificates in your room. It will give you motivation for doing success in future studies.

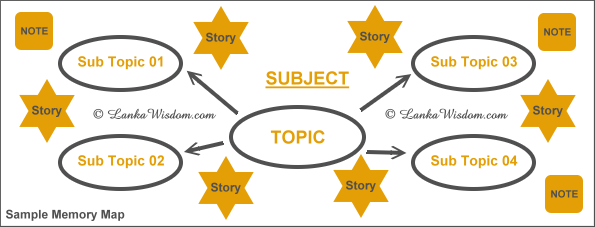

- Read psychological books related to learning secrets. Use memory maps when you study. You can make a song to remember some names, make a story to remember tables, etc...

- Use the center of white sheets to write something. When you happen to remember some graphs, write them on the center of white sheets then see them in your free time. Don't forget, if you see something for a long time every day, it will automatically be remembered such as we remember our close one's phone numbers.

- Some people learn from seeing, some learn via listening but others are learning from hand working. Try to find out your learning methods then use them rather than other ways. Also, use multimedia education materials with help of a computer when you are learning. Use yourself to explore the Encyclopedia or Dictionary.

- Analyses your experience with your past learning mistakes. The best way to learn is to analyze mistakes that happened in your past years. Try to understand yourself.

- So use these guides lined to be the best and fast learner. Take education as an easy task. It is Hobby. Below the image is a sample memory map.

Simple Buddhist Daily Meditation for Positive Energy

- NLP scientists were found by using quantum physics that light signal travel around the earth has a frequency of 7.5Hz. (By using the formula c=fλ, c is the speed of light & λ is the distance around the earth).

- But also when we are staying in Alpha levels such as in - mediation, relaxation music, Mother Nature or certain temples, shrines - then our EEG brain frequency also so close to 7.5Hz.

- So this concept proves that we can get what we hoped things easily if we are at alpha level or in mediation.

- However, you can practice simple meditation called "Meditation of All Wealth". This will help you to gain a lot of money, treasure, happiness & calm in your life.

- Meditation helps to link us with the universe and other energy beings.

- Firstly stay in a silent place. Close your eyes then think this way. This meditation has a circular thinking method. To start like this:

- Every being may stay in good health!

- Every being may gain money, house, relations & other physical things!

- Every being may stay with a brave & relaxed mind!

- Every being may observe virtuous precepts in their life!

- Every being may achieve their life goals easily!

- Every being may have happy & lovely family life!

- Every being may achieve their spiritual goals!

- Every being in the universe may stay Happy, Calm & Freedom!

- This is the end of this mediation, so you can do one cycle or increase cycles on daily basis.

- Then you will feel great happiness and then after six months of the period, you will see great physical & mental differences happening in your life!

Interview Dos and Donts: Successful Interview Tips

Interviews are common for get a new job, trying for promotion, refreshing job areas, starting afresh love affair, marriage proposals, and many more occasions. Here we are going to show you some tips for passing your interviews well. Before face to interviews, we need to send cover letters & resumes (also called CVs or bio-data) to companies. But before that, you must have a clear idea about what kind of job you need when compared with your skills. People who have small oral skills must not find a job as sales reps. A person who can't do computer typing, must not seek a job as a clerk. When you find jobs you must consider targeted job titles, their main tasks & purposes, what kind of skills are needed, qualifications you needed, special requirements for the job title & main terms of conditions in that job. After you got the invitation letter for interviews, you must research that company or organization under the following facts:

- Who is the owner of the organization, are its main products or services?

- Organization structures, departments, branches, outlets, factories & Subsidiaries?

- Where are they located? Capital organization? Top-level managers & director board?

- Organization reputation, strengths, weaknesses, employees, customers?

- Market shares, what do people say about that organization?

- Main advertisements or procedures? Company website?

Read transcripts, books, magazines related to facing interviews, Good Luck For Your Interviews! Then you have a good preparation for facing this interview. Sometimes interview boards have a group of people or sometimes only one person. Here are some last-minute interview tips for how you want to behave in interviewing period:

| Do | Don't |

|---|---|

| Be prepare, punctual & relax | Be boring, creep & over friendly |

| Care about your appearance | Talk well when refer people like Mr.. or Mrs.. |

| Listen to questions then speak well | Don't criticize society or people |

| Be friendly, polite & calm | Let interviewers finish his questions |

| Expand your answers | Don't argues with interviewers |

| Look direct at interviewers | Don't over boast your strengths |

| Keep your copy of CV, pen & blank paper | Don't say any lie or suspecting facts |

| Be truthful, substantiate & show your strengths | Don't wear fancy cloths or use mobile phones |

Common Top 20 Interview Questions and Answers for Freshers:

- Where were you born? Where do you live now? Do you like this city?

- What does your parent do? Do you have brothers & sisters? Are you enjoying life?

- What do you think about this job & your application form for this job?

- What do you do for relaxation & leisure? Do you like sports & have joined any clubs?

- Do you read newspapers? Do you watch business news on TV? Whose are your favorite authors?

- What is your school? What did you think about your school teachers?

- What is your most liked subject? What do you think about your school? Why do you like these subjects?

- What do you do normally in school or university holidays? Why are you bad with these subjects?

- What's the hardest thing you have had in your past job? Do you like your current boss?

- What you had failed to achieve in your current job? What does your boss think about you?

- Why do you want to join this company? What do we do here? Why should we employ you?

- How much money do you want? Were you sacked? Why do you keep blank these areas in your resume?

- So can you sell me this pen? What do you do if ...? What do you think of ...?

- Tell me all about...? What have you done in the past ten years? What do you think about your colleagues?

- Tell me what you know about our product or services? Can you talk well via phone?

Team Working - Concepts & Theories

A team is an energetic group of people, who work together to achieve a particular goal & wish high results than working alone. All team members are, motivating each other, combining their skills, improving their creativity & developing efficiency via effective participation. As an example, two couples married are can consider a basic team. People who build software also work as a team, like designers are creating user interfaces, software engineers are doing calculations, preparing concepts, developers are doing programming, marketing members can do field research and trainers do fault finding, while system administrators are managing all work. There are eight factors involved in building an effective team:

- The team must have clear goals, which can write down on paper

- Resources can be used to gather each other such as room, chairs, tables, etc...

- The team is controlled by simple rules & leadership

- Each member must have good communication skills even via email, chatting, or text

- All team works must be reassessment by leaders in particular periods called group meetings

- After small periods such as one week, all team members must gain measurable results

- Every once after reassessment, members must renew their environments or roles

- All members must have a good understanding of each other member's skills

Team members are individually affected to the success of their team with good communication skills such as writing reports, orally talking by phone calls, sending texts or emails. All teams have leadership, who is doing planning, organizing, decision making & motivate his members. Some teams have two or more leaders. Analytical thinking & improving own skill are the main responsibilities of other team members. All team members must have clearly defined roles. One member must write down all decisions that were made in group meetings. All members participate in their team physically or via electronic media. Always Remember the formula Of TEAM = Together Everyone Achieve More. A good Team must have the following performances:

- A very small number of members related to one task

- All members have good skills in their roles,

Eg.. some can talk very well, but some have technical skills - Equally committed to a common purpose or goal

- Working approach for which they hold themselves mutually accountable

- Deeply committed to one's another personal

- Gaining success daily & grow reputation among the team

- Methodology for handling facilities

- Face tensions come from outside & own weak points

- Clear organizational charts for all members & their tasks

- Collecting feedback from outside & inside people

- Respect for internal rules & common human qualities

- Awareness of group process till finish main goals

How we can succeed in becoming wealthy

People who have no money

People who are not successful in gaining wealth always happen to search for money and tend to have a stressful mind thinking about their financial future. They are often trapped into leasing or taking loans and happen to follow behind people who have money. These people don't practice proper economic management in their life. Being satisfied with what we have is not always practical as there is always a chance we can face misfortune in our personal life, our career life, our businesses or in the natural world.

People who have money

People tend to be calmer and more relaxed when they possess a sufficient amount of money. This allows them to take life decisions with a clear mind. They don't have fear about the future and have a fresh mind, allowing them to produce creative ideas. They can invest extra money in learning new skills, buying properties, depositing it in a bank or starting up new businesses. As a good practice, they calculate daily loss & profits in a book. Wealthy people always separate a certain amount of money as insurance for their life and properties.

Discipline of saving

Saving money with the bank is considered to be the main step in becoming rich. We need to have motivation and discipline in order to regularly save a fixed amount of money. It must be considered as a necessity in the same way as purchasing food. It is recommended to save at least 10% of your total income per month. Saving money can also be regarded as Financial Independence because it helps to make our mind free. We also need to think about how we save, such as depositing it in a bank account, buying land, buying property or purchasing gold etc. When we deposit money with the bank, they then invest this money by giving loans to micro businesses and corporate projects. Hence, investing money with the bank directly helps to develop our country towards prosperity.

Dealing with Banks

It is important that we take the right approach when it comes to dealing with banks or other financial institutions. Normally with banks, we can maintain three types of money accounts. These are - Savings Accounts, Current or Cheque accounts and Fixed Term Deposits. With the use of ATM cards, people nowadays regard savings accounts as the same as current accounts. Current accounts are used mainly to perform daily money transactions whilst any leftover savings is not considered to be in that account except in the case of collecting money from businesses or from a salary. Savings accounts are used to keep savings as a way of self discipline. Hence we need to restrict the withdrawal of money via ATM cards. It is suggested to take enough money for a week as a good habit to restrict spending when handling ATM cards. If you need to take money from your bank account, always use your current account instead of your savings account. Depositing a fixed amount from your monthly income into a separate savings account is one way to encourage good saving habits. Fixed term deposits are another way to discipline our mind and our spending habits, enabling us to steadily save while earning higher interest rates from banks or other kinds of financial organizations.

Common types of Financial Traps

- Investing with illegal financial institutions, insecure banks, and fraudulent people.

- Purchasing lands and homes which have illegal documents and are conjoined with law cases.

- Gold or instruments which do not have true chemicals compounds or internal components.

- Leasing or loan advertisements that force borrowers to pay back with excessively high interest.

- Having long-term faith in winning lotteries is also a potential financial trap created in our minds.

Leasing and Loans

Many people take on loans without thinking how they are going to pay it back. Some people take on loans relying on uncertain future plans such as earnings from a foreign job, incomes from new businesses or with an insufficient salary. It is not suitable to undertake loans or to lease if your intention is to obtain fancy things. Loans or leasing should only be taken for new investments. As example, if we need a new investment of Rs.100, then we must have 75% with us, which is not included from the loan. We should expect to use only 25% of our total needs from leasing or loans. Also the 25% we acquire from the loan must be saved in the bank and should not be used in the investment. This amount is required to pay back the loan, in case you are unable to earn funds from your investment as initially planned. A lot of people take loans because of attractive advertisements. But ideally we should always remember that undertaking loans & leasing helps to give us added mental stress, physical sicknesses and can potentially cause family problems too.

Handling Credit Cards

Bad usage of credit cards is another way people tend to waste or lose money. Credit or debit cards can make our money vanish easily within minutes. Online purchases, shopping in super markets and foreign traveling can all contribute to us wasting money if we do not know our limits. Credit cards can create money, so mentally we don’t identify it as another kind of loan. To save money from spending excessively, we want to keep a monthly limitation on our card purchases. We also need to take care in paying our credit card bills on time in order to avoid interest collections. Before we go to the super markets, we should prepare a goods list after consulting with family members. Always collect bills and analyze extra purchases beyond the list. This will help to reduce going over your budget in future. Maintaining a family or personal money book is also another good method to keep track of spending. Essentially, we need to have self-discipline in order to avoid extravagant spending.

Money and Personality

- Richness is a relative state which means a rich person in a village can be a poor person in a suburban town.

- With the extra money, extra social acceptance and bravery can be earned.

- Rich people attain a positive mind, luxurious life, and have a nice appearance.

- Rich people have the opportunity to gain fresh ideas and meet new mentors.

- When we have extra money, we have more free time to do activities such as meditation and merit activities.

Ways of wasting money

- Spending unnecessarily on lust such as buying clothing, meals, entertainment, etc.

- Undergoing expenses without taking into account any financial planning & analysis in your daily life.

- Paying for services & goods which can be done by yourself, such as shaving in a saloon.

- Wasting time thinking negatively about the past - wasting time means wasting money.

- Understanding religious concepts from the wrong point of view, such as - about saving money.

Ways of being successful with money

- Use your land to cultivate vegetables, cooking spices, herbal trees, flowers, and fruits rather than buying those things from the shops.

- Read books related to successful people and affluent companies, then write down their tips to become wealthy. Try to understand their weak points.

- Undertake an extra job, become self-employed on a part-time basis or as a family business during the evening times or holidays.

- Prepare a simple home-based lost & profit money book related to daily, monthly and yearly expenses. Analyze it every weekend.

- Give donations with a happy mind from your monthly income to poor people, priests, gods & monks.

Buddhist Saving System (BSS)

Think as your total monthly income is Rs.100, then separate your funds as following:

| Monthly Family Expanses | Invest Again in Business | Savings for Future |

|---|---|---|

| 25% | 50% | 25% |

Sample Personal Economic Management System Per Month

Consider your monthly income is Rs.100, then keep your expanses as following:

| Daily Needs | Savings | Investments | Hobbies | Merit Works |

|---|---|---|---|---|

| 60% | 10% | 10% | 10% | 10% |

By Brian Ranasinghe

Author belonged to an ancestral herbal medicine family in Sri Lanka. He learned ancient astrology from various teachers in Sri Lanka & India. He is working as freelancer web developer in USA.

Last updated: 2023 January 21th